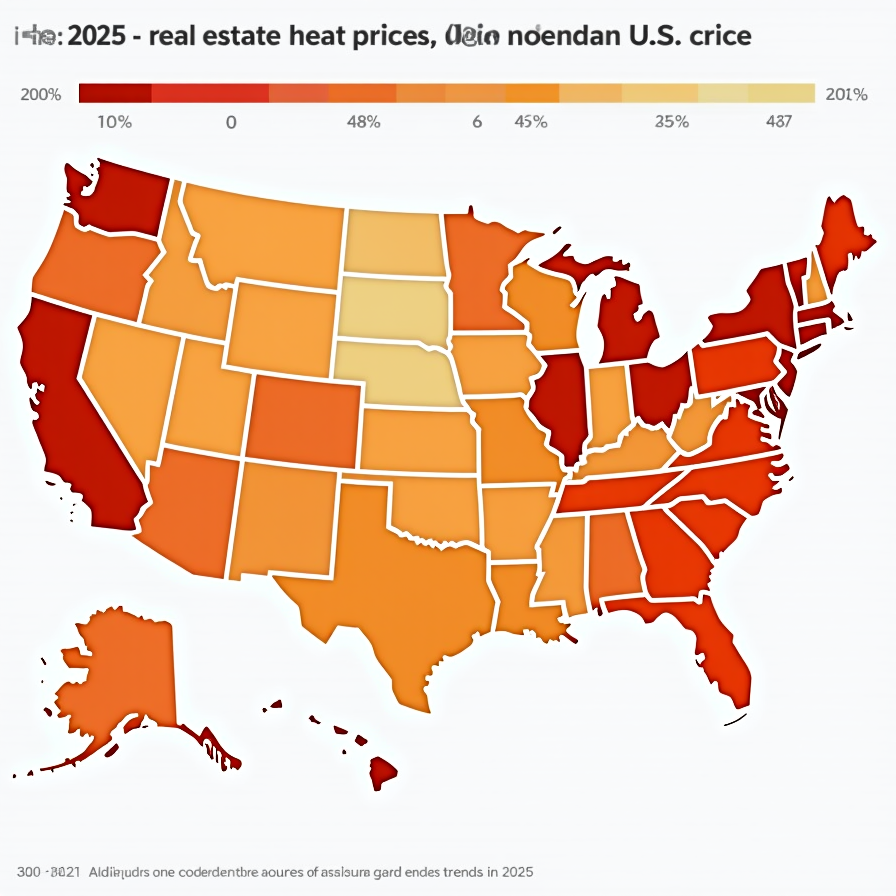

The housing and mortgage markets are poised for significant shifts as we approach 2025. With affordability challenges weighing heavily on homebuyers across the U.S., the industry is rife with anticipation of a potential market transformation. Experts predict a mixed bag—some regions may see a drop in home prices, while others continue to experience stability or even growth. A noteworthy trend is the increasing role of real estate investors in the market, which is expected to further impact affordability. Additionally, the mortgage sector is bracing for changes, with new data standards and AI applications set to revolutionize the industry. As the third quarter of 2025 unfolds, buyers may gain a slight advantage due to a surge in inventory. Stay tuned as we explore these trends and more in detail.

The U.S. housing market in 2025 presents a picture of complexity, driven by varying regional trends and investor activities. Affordability remains a critical challenge as home prices stay elevated in many parts of the country, influenced by both demand and real estate investors flooding the market for acquisitions. However, certain areas are beginning to see a transition. According to MPA Mag, “Affordability challenges are continuing to weigh against homebuying activity across the US, with home prices remaining stubbornly high.”

According to Bankrate, the third quarter of 2025 is expected to witness continued high home prices, although an increase in inventory could provide potential buyers with a strategic advantage. Forbes highlights that while “home prices are declining in some markets—and rising in others,” the new landscape could mean opportunity for some and further challenges for others.

In the mortgage industry, novel policy changes and evolving technologies are making waves. New mortgage policies are poised to help first-time homebuyers qualify more easily. Additionally, AI applications are being incorporated to tackle bias and enhance data processing across the industry, setting new benchmarks for mortgage operations. As RISMedia reports, “Mortgage applications continued to grow last week, with a 9.4% jump reported.” The upcoming years are set to revolutionize the way mortgages are processed and approved, presenting both opportunities and obstacles for stakeholders.

Affordability challenges are continuing to weigh against homebuying activity across the US…

Source: MPA Mag

Home prices are declining in some markets—and rising in others…

Source: Forbes

Industry experts expect continued high prices in Q3, but a sharp increase in inventory is giving buyers a bit of an edge.

Source: Bankrate