Navigating the 2025 Real Estate Landscape

The housing and mortgage sectors are experiencing significant transformations as we move into 2025. With affordability levels impacting traditional buyers, investors are becoming dominant players, reshaping the dynamics of the U.S. market. Predictions oscillate between declining home prices in certain regions and price hikes in others, leaving potential homeowners and investors alike pondering the optimal timing for buying property. Furthermore, high inventory levels offer a unique edge to buyers not seen in recent years, while the builders’ confidence sees unexpected dips. This evolving scenario demands astute observation and strategic positioning for anyone involved in real estate. Prepare to be intrigued as we delve into the prominent trends shaping the industry.

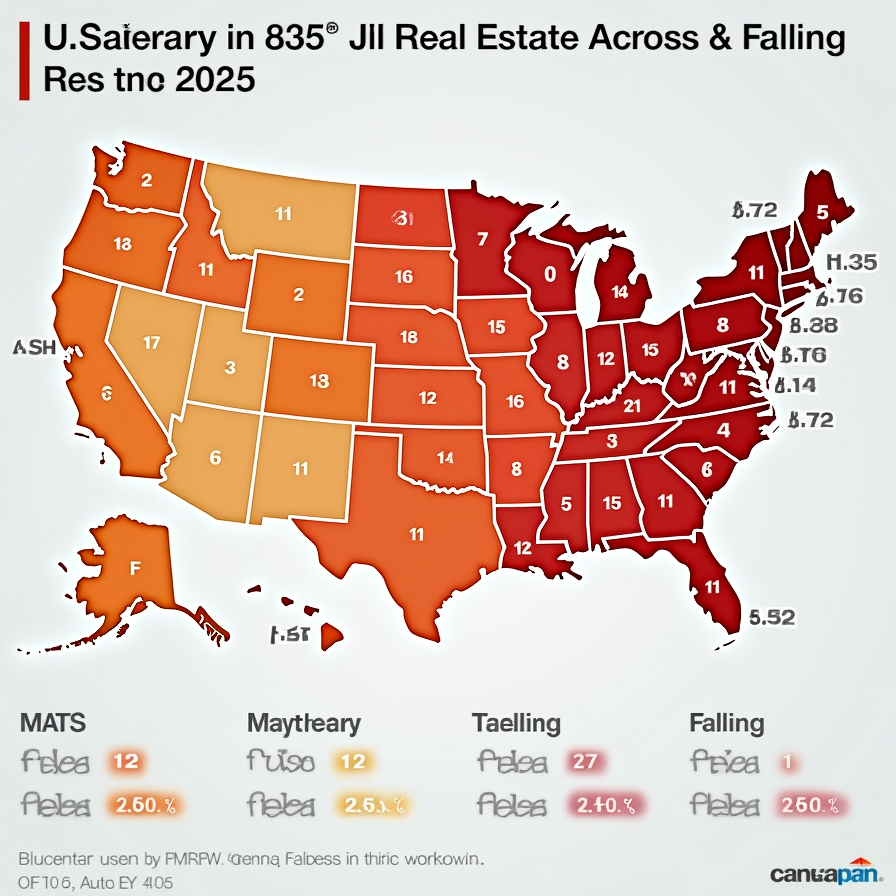

The housing market in 2025 is marked by notable trends that are reshaping the buying and selling dynamics. Among these, the significant rise in inventory levels is creating a buyer-friendly environment unseen in recent years. Home prices continue to sway, with some markets expecting a decline while others are bracing for an increase, demanding careful attention from both buyers and investors.

Looking ahead, 2025 promises to be a pivotal year for the real estate and mortgage markets. The fluctuating home prices, coupled with a unique advantage for buyers due to increased inventory, suggest a redefinition of market strategies.

With these trends, stakeholders within the housing market must remain vigilant and adaptable, ready to pivot as circumstances dictate. The interaction of these factors is pivotal in crafting strategies that align with shifting market realities.

Investors are scooping up homes before buyers even have a chance as housing affordability worsens.

Source: MPA Mag

Home prices are declining in some markets—and rising in others. Here’s where experts predict the housing market is headed in 2025.

Source: Forbes

Prospective buyers are backing off because housing costs are near record highs, with the median home-sale price up 1.2% year over year and the weekly average…

Source: Redfin