Exploring the 2025 Housing and Mortgage Landscape

As we venture into 2025, the real estate market is teeming with dynamic shifts and potential opportunities. While some regions witness a cooldown in home prices, others continue to experience fluctuations, challenging potential buyers and investors alike. At the heart of these changes is the pivotal role of mortgage rates, influencing buyer decisions significantly. This blog delves into the prominent market trends and expert predictions that are shaping the housing landscape this year. From rising investor activity to strategic market decisions, understanding these elements is essential for navigating the complex real estate environment of 2025.

The US housing market in 2025 presents a mixed bag of challenges and opportunities for buyers, sellers, and investors. With affordability still being a significant concern, the influence of real estate investors is notable. The past few years have seen investors increasingly stepping into the market, often outbidding regular homebuyers, which keeps prices elevated. This trend is expected to continue, further complicating the usual dynamics of supply and demand.

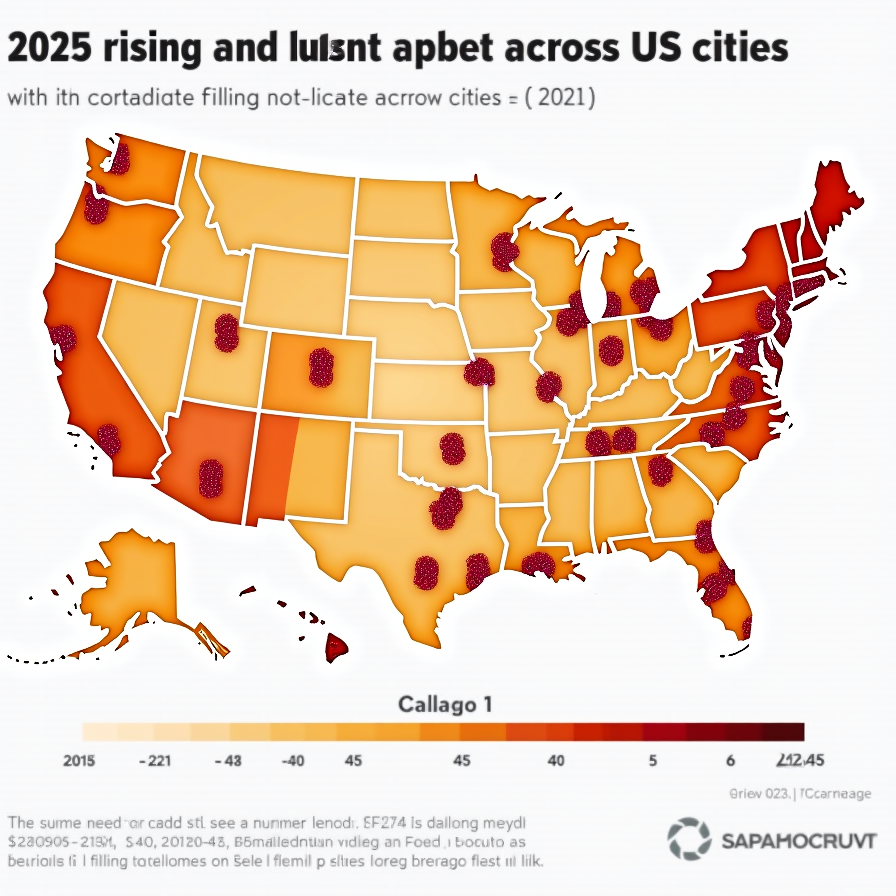

The year 2025 sees a continuation of significant trends from previous years, with experts making bold predictions. The housing market experiences varied price adjustments, with some areas seeing drops in home prices due to decreased demand, while others witness rises owing to local economic factors and inventory levels. A critical trend to watch is the potential impact of sustained high mortgage rates, which could exceed historical norms and reshape buyer affordability and market strategies.

Affordability challenges are continuing to weigh against homebuying activity across the US…

Source: MPA Mag

Home prices are declining in some markets—and rising in others…

Source: Forbes

Industry experts expect continued high prices in Q3, but a sharp increase in inventory is giving buyers a bit of an edge.

Source: Bankrate